Table of Contents

Support

MYGA Special Rates FAQ's

What do agents need to do to be eligible to sell Fidelity & Guaranty Life Products?

Agents must be active, and must have completed FG Guarantee-Platinum 5 product training as well as appropriate state suitability training. If you have questions, please contact Sales Support at 800-445-6758, Option 1 (Annuity), Option 1 (Application Submission Questions) and ask to speak to any one of the service representatives and they will be happy to assist.

What must clients do in order to take advantage of this interest rate special?

Clients must agree to sign the application electronically in order to complete this process. Client must also have an active email account.

What is the maximum premium I can submit?

The maximum premium is $1M.

What if I have to submit additional forms such as checks or transfer paperwork?

-

Submit checks to the normal annuity business address: 777 Research Drive, Lincoln, NE 68521 or P.O. Box 81497, Lincoln, NE, 68501

-

Submit transfer paperwork to Fidelity & Guaranty Life Insurance Company, Attn: New Business, Two Ruan Center, 601 Locust Street, Des Moines, IA 50309

What will the effective date of the policy be?

Annuities are issued on the business day that funds are received and application and additional documentation are received in good order.

Why is Fidelity & Guaranty Life only accepting applications submitted electronically?

Because the interest rate increase is only offered for a limited time, we want to process your application as quickly as possible. Submitting applications through our SalesLink app will help us do this. Also, we want to help you embrace our newest technology, which will benefit us all moving forward!

Will any hard copy paper or faxed apps be accepted for the internet rate special?

Any sale involving a non-natural owner will need to be entered using the electronic application. Please refer to Non-Natural Owner section of this Wiki.

What happens if my client determines they do not want to sign electronically?

Unfortunately, we would not be able to accept your client's application under the interest rate special program.

When does the interest rate special begin? What products are included?

The interest rate special begins November 30, 2015 for the FG Guarantee-Platinum 5 product ONLY. The interest rate special is for a limited time. Agents will be notified shortly before the special ends. Before your client appointment, please check our agent portal SalesLink or with your IMO to ensure the special is still available.

What is the interest rate for the special FG Guarantee-Platinum 5?

The interest rate is 3.15% for the special.

Will you accept cash with app and 1035 exchanges?

Yes, we will accept both.

Will production amounts generate during the special count towards the Power Producer Program or the Power Producer Conference?

No, production during the FG Guarantee Platinum 5 special does not count toward either the Power Producer Program or the Power Producer Conference.

Where do I go to access the online application?

The application can be accessed through a web browser on a PC, iPad or any tablet device and requires an Internet connection.

View directions for accessing the application from SalesLinkHow do I find out my SalesLink user name and password?

You can call toll free line at 800-445-6758

Option 1 (Annuity), Option 1 (Application Submission Questions) or

Email us at SalesLinkhelpdesk@fglife.com

What browser should I use?

The SalesLink online application will work best in the following browsers:

-

Internet Explorer 9, 10 and 11

-

Chrome Version 35 (Preferred)

-

Firefox 29

Online application is currently not compatible with Safari browser on Mac computers. You can alternatively try downloading Chrome browser for Mac.

SalesLink FAQ's

Contracting & Training FAQ's

What happens if I have not taken my proper F&G product and state suitability training?

If you have not taken your proper F&G product or state suitability training, you will receive an error message indicating you are not eligible to sell the product and will not be able to proceed until those requirements are met. Once you have met the requirements, you will be able to proceed with the online application.

How best do I complete my proper FGL product and state suitability training?

You can go to the F&G SalesLink® home page, select Required Training Agent & Product under the Popular links and take the FG Guarantee-Platinum® Series product training. SalesLink also contains a link to our preferred vendor Success CE where agents can complete the required suitability training. Agents have been pre-registered with SuccessCE. The training completion is electronically sent to F&G upon completion. Agents can also fax in a copy of the suitability certification if taken by other approved training providers to 410.895.0129.

How soon will I be able to continue completing my online application after training has been completed?

SalesLink should be updated with your F&G product training within a few minutes and state suitability training within 48 hours.

Who do I contact if I have questions on F&G product or state suitability training?

If you have questions, please contact Sales Support at 800.445.6758

Option 1 (Annuity), Option 1 (Application Submission Questions) and ask to speak to one of the service representatives and they will be happy to assist.

What type of validation will occur when completing the application online?

The SalesLink online application will validate for: proper required product and state training have occurred, all required fields are completed on the application and supporting documents, and suitability requirements. A case that does not meet suitability requirements will be declined and will not allow you to submit the application.

Application Process FAQ's

Are there any additional forms required to be submitted for cash with an app?

You must write the assigned policy number on the check and submit to our new business address provided in question 2 below.

Where do I submit my check as well as any additional documents?

-

You may submit additional forms to the normal annuity business address: 777 Research Drive, Lincoln, NE 68521 or P.O. Box 81497, Lincoln, NE, 68501

-

Transfer paperwork with policy # referenced on it should be mailed to Fidelity & Guaranty Life Insurance Company, Attn: New Business, Two Ruan Center, 601 Locust Street, Des Moines, IA 50309

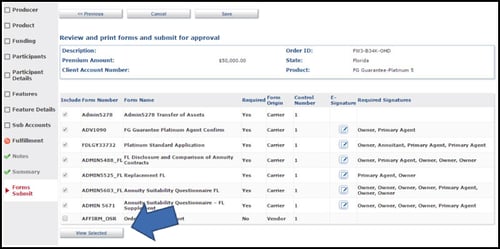

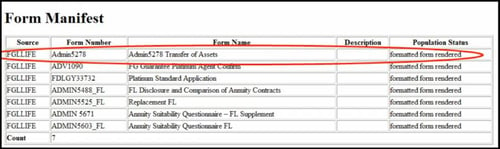

Here are the instructions to print the Transfer form (see screenshots below):

-

Click the “View Selected” button

-

Open the PDF created and print the ADMIN5278 form(s). Please make sure that you have populated the Transfer Companies address on page 1 of the form

-

Have your client sign the form(s)

-

Write the policy number assigned by the system at the top right corner of each page

-

Mail the document to Fidelity & Guaranty Life Insurance Company, Attn: New Business, Two Ruan Center, 601 Locust Street, Des Moines, IA 50309

*Click images for larger views.

How will I obtain signatures on the application and supporting paperwork?

The SalesLink online application offers e-signature which can be obtained in person when you are meeting with your client or remote signature by email to your client.

When applying an electronic signature, what is the proper access code?

The e-signature access code for the owner/annuitant is the last 4 digits of their SSN and the access code for your signature as the agent is the last 4 digits of your SSN.

What happens if I start an application but decide to finish it later in the day or another day?

You can start an application and save it at any point as you proceed through each of the entry screens. When you go back in to complete the application, select “view applications”, the proper agent number and hit next. Click the “show all” button and you will see all the cases that are in progress and have been submitted for processing. In the first column next to the case you want to edit, click on the pencil and proceed to complete your application.

Once I submit the application for e-signature, can I make changes to the content in the SalesLink Online application?

No, once you hit the submit button to begin the e-signature process, you cannot make any changes to the content entered. However, any time prior to hitting the submit button you can make changes to the content.

What happens if my client determines they do not want to sign electronically or do not have an email address?

Unfortunately, if your client does not have an email address or decides they do not want to sign electronically, we would not be able to accept their application under the interest rate special program.

Why does my application time out?

To ensure the security of your and your clients' data there is a time out feature on the application. Please remember to hit the save button before leaving your desk so you don’t lose your data.

How soon will I be able to check SalesLink for the status of my application?

SalesLink should be updated with your new business within 48 hours of when the application is received.

What additional documentation is needed for a non-natural owner?

-

Trust: Need the Non-Natural Ownership Form (ADMIM5456), a copy of the First and Signature Page of Trust, and the Certification of Trust (ADMIN5663) if irrevocable OR Verification of Trust (ADMIN5662) if revocable

-

Corporation of Partnership: Need the Corporate Board of Resolution and Non-Natural Ownership Form (ADMIN5456)

-

POA Involved: Need a copy of the POA Paperwork

What if I have questions while I'm trying to submit my electronic app?

Training materials are located on SalesLink. You can login from the homepage of our website at https://www.fglife.com by clicking the login button on the top right and then selecting “Financial & Insurance Professional”, or click the link below to navigate to SalesLink directly.

Visit SalesLinkIf I still have any questions while I'm trying to submit electronic apps, is there someone I can contact?

You can contact us at 800.445.6758, Option 1 (Annuity), Option 1 (Application Submission Questions) from 8 a.m. to 7 p.m. ET.

What if I have any questions about my application after I've submitted it?

Please visit SalesLink under Your Business, New Business for the status of your application or contact us at 800.445.6758, Option 1 (Annuity), Option 2 (New Business Status).

Visit SalesLinkResolving Licensing, Appointment, CE or Product Training Issues

In order to complete the appointment process and to activate your agent number, please login to SalesLink® using the directions below.

Here is how to login:

-

Visit SalesLink at https://saleslink.fglife.com/

-

User Name: {AgentContractNumber}

-

User Password: lower case (s) and your nine digit social security or tax identification number

-

Commission Statement PIN: {PIN}

SalesLink is a tool designed for your business needs and is an important part of how you can easily do business with F&G! On SalesLink, you can obtain and/or order:

-

Marketing Materials

-

Product Information & Current Interest Rates

-

Commission Information

-

Marketing Collateral

-

Applications & Forms

-

Underwriting Guidelines

-

Pending Business Reports (with outstanding requirements)

-

Sales Tools, Tips, Calculators, etc.

You get the idea: SalesLink is where you can find most of the things you need to do business with F&G.

Reminder, state taxes will be withheld from your commissions in accordance to the state regulations.

To ensure you get paid, please use this number on applications for new business.

Errors & Omissions Certification:

As a Fidelity & Guaranty Life Insurance Company or Fidelity & Guaranty Life Insurance Company of New York producer you are required to maintain Errors & Omissions (E&O) Coverage for Alabama, Kentucky, Massachusetts, Mississippi and Rhode Island, F&G will hold commissions on business written in those states for producers who do not provide us with a current E&O certificate.

The USA Patriot Act requires insurance companies to develop and implement Anti-Money Laundering (AML) programs. F&G has partnered with LIMRA International to provide AML training. All contracted agents are required to complete the LIMRA AML Training or provide satisfactory evidence to us of completed AML training within the last 24 months. Certification should be mailed to the address listed above. Instructions for accessing the LIMRA Training Module are enclosed. F&G will hold commissions on business for producers who do not provide us with a current Anti-Money Laundering certificate.

Pre-Solicitation States:

As an F&G life producer, we want to take a moment to help you ensure you are ready to conduct business with our company.

Please let this serve as a reminder there are the pre-solicitation States where agents cannot solicit business until their appointment with F&G has been approved by the state either because it is state or company mandated. PLEASE BE ADVISED THAT YOU ARE NOT AUTOMATICALLY APPOINTED IN THESE PRE-SOLICITATION STATES SIMPLY BECAUSE YOUR RESIDENT STATE APPOINTMENT HAS BEEN PROCESSED. You must specifically and separately request an appointment in the pre-Solicitation states.

You must ensure your appointment is active prior to solicitation in the following states: AL, DE, DC, GA, IA, LA, NM, NC, PA, PR, SC, TX, UT, WI and WY.

You can go to the state site to confirm your appointment with F&G at http://www.naic.org/state_web_map.htm or call our Sales Support Center at 800.445.6758 and our service representative will check our commissions system to confirm the states you are appointed in and the effective date of those appointments.

If you requested an appointment in California or Iowa it is mandatory for your General Continuing Education Certifications to be completed prior to your soliciting business or being appointed with our Company. This includes the Iowa one time certification of “Permitted Producer Activities” certification.

IMPORTANT! There are six education requirements in order to submit new business; if you fail to comply with the training requirements business will be rejected (or commission held where indicated*):

-

Anti-Money Laundering (AML) Training*

-

F&G Product Specific Training

-

State Specific CE Requirements

-

State Specific Annuity Suitability CE Training

-

Iowa Permitted Activities Certification (for all IA Resident and Nonresident business - see Compliance Corner on SalesLink for detail and certification)

-

Specific Annuity Product Suitability Training Modules, as applicable

Additional information and links to fulfilling these requirements can be found on SalesLink in the Training section.

Common Questions and Answers:

What happens if I have not taken my proper F&G product and state suitability training?

If you have not taken your proper F&G product or state suitability training, you will receive an error message indicating you are not eligible to sell the product and will not be able to proceed until those requirements are met. Once you have met the requirements, you will be able to proceed with the online application.

How best do I complete my proper FGL product and state suitability training?

You can go to the F&G SalesLink home page, select Required Training Agent & Product under the Popular links and take the FG Guarantee-Platinum® Series product training. SalesLink also contains a link to our preferred vendor Success CE where agents can complete the required suitability training. Agents have been pre-registered with SuccessCE. The training completion is electronically sent to F&G upon completion. Agents can also fax in a copy of the suitability certification if taken by other approved training providers to 410.895.0129.

How soon will I be able to continue completing my online application after training has been completed?

SalesLink should be updated with your FGL product training within a few minutes and state suitability training within 48 hours.

Who do I contact if I have questions on FGL product or state suitability training?

If you have questions, please contact Sales Support at 800.445.6758 and ask to speak to one of our service representatives and they will be happy to assist.

What type of validation will occur when completing the application online?

The SalesLink online application will validate for: proper required product and state training has occurred, all required fields are completed on the application and supporting documents, and suitability requirements. A case that does not meet suitability requirements will be declined and will not allow you to submit the application.

Suitability Criteria

We know you share our commitment to good sales practices when selling annuity products. An important regulatory requirement that must be followed is to recommend purchasing an annuity to a client only if there are reasonable grounds for believing the annuity is suitable.

We encourage you to familiarize yourself with the following information and key documents at the end of this section to better understand our program and help ensure that your clients' applications get processed as quickly as possible. These vital documents are also available on SalesLink®.

Why is suitability so important?

In selling annuity products, it is important that agents assist clients in determining which products are appropriate for their financial situation based on financial needs and objectives as disclosed by the client during the sales process. It is also very important that agents give clients the information necessary to make well-informed decisions relating to the purchase of an annuity. These two pillars of good sales conduct – understanding your customer’s needs and objectives and providing full disclosure - are not only requirements of the law, but they are also dictated by our company’s code of ethical conduct to ensure we are always acting in a manner consistent with our clients’ interests.

How exactly does your electronic review process work?

All applications submitted through the electronic platform are reviewed to determine whether they meet our minimum criteria. Generally, our minimum criteria include:

-

Remaining liquid assets (after the purchase of the annuity) of at least $20,000;

-

Remaining liquid assets (after the purchase of the annuity) of at least six months of Approximate Monthly Household Expenses if employed or retired and twelve months of Approximate Monthly Household Expenses if unemployed;

-

Approximate Monthly Household Income of at least $1500 (exceptions made for applicants with significant remaining liquid assets);

-

Monthly Disposable Income of at least 10% of Approximate Monthly Household Income (exceptions made for applicants with significant remaining liquid assets);

-

Surrender charges no greater than 3% on replaced annuities for applicants aged 65 or over;

-

Annuities funded out of liquid assets not greater than 50% of Total Liquid Assets for applicants aged 65 or over (exceptions made for applicants with significant remaining liquid assets);

-

Annuities funded out of liquid assets not greater than 75% of Total Liquid Assets for applicants under age 65 (exceptions made for applicants with significant remaining liquid assets);

-

Applicant may not reside in a nursing home or Assisted Living Facility;

-

Applicant may not have a reverse mortgage – regardless of whether the reverse mortgage is a source of funding for the annuity;

-

Applicant may not have an Aggressive Risk Tolerance if the annuity represents a significant percentage of Total Net Worth;

-

Reasons for purchasing the annuity may not be to qualify for government programs, Medicaid or VA benefits;

-

Anticipated distributions may not be within the surrender charge period unless distributions are surrender charge free;

-

Applicant must not anticipate adverse changes in assets, expenses or income during the surrender charge period;

-

Applicant must indicate remaining liquid assets are adequate to handle emergencies;

-

In cases of replacement, prior replacements within the prior 36 months (60 months for California or Minnesota applications) may not involve the same agent and same funds.

Applications not meeting these criteria will usually be declined. We purposely share the above criteria with you so you know in advance about our minimum standards and can use them in deciding whether an application should be submitted to our company.

Applications that meet these criteria may be put through an additional screen to determine whether the information on the Suitability Acknowledgement Form raises any other suitability concerns that may require follow up with you or your client.

What happens if an application is denied for suitability reasons?

If it is necessary for the company to decline an application because we do not find reasonable grounds to determine the recommendation was suitable, then you will be informed of our decision to decline the application to avoid any surprise and allow you to discuss the matter further with your client.

Keep in mind that our declination of an application for suitability reasons does not mean the recommendation was necessarily unsuitable. It only means the information supplied by you and your client, from the company’s perspective, does not adequately establish reasonable grounds for believing the annuity is suitable.

Where can I download forms?

Please click on the links below for additional information:

Suitability Acknowledgement Forms (ADMIN 5463)Suitability Instructions and Definitions (ADMIN 5542)

Fidelity & Guaranty Life Market Conduct Guide

Contact Us

Have additional questions? Visit our agent portal SalesLink for other training resources. You can also contact us directly at 800.445.6758 from 8 a.m. to 7 p.m. ET with specific questions:

-

Application Submission Questions - Option 1 (Annuities), Option 1

-

Pending Application Status - Option 1 (Annuities), Option 2

-

Contracting and Commissions - Option 4